The effect of the pandemic on company insolvencies

The government has announced further measures to support businesses as the pandemic continues – this time extending the furlough scheme to the end of March 2021 and giving more help to the self-employed.

The apparent philosophy behind the government’s actions is that it is better to support otherwise healthy businesses that are at risk of failure due to the pandemic – and the measures they have taken have been broadly welcomed.

The measures, however, have been relatively untargeted to date with a mixture of employment support (furlough), local authority grants for small businesses, rates relief and a wide range of government guaranteed loans.

There has also been significant pressure on banks to lend, without government support, to existing borrowers.

It is hard to deny that the combined effect of all these measures has had the intended effect of preventing a wave of corporate failures, and this has to be welcomed.

However, it is worth looking into the statistics in more detail.

The Insolvency Service has collated data on company insolvencies for many years, but these data get relatively little exposure.

It is a sad fact of business life that some businesses fail.

Normally, in a vibrant economy, weak businesses fail, employees are rehired elsewhere, customers and assets are purchased or secured by stronger businesses, and trade and employment continues. It is seen as a necessary part of the capitalist economy.

But what I think we are now seeing, though, is the delayed failure through government measures of businesses that would, but for the pandemic, have failed anyway.

There are two graphs shown below:

The first graph is the quarterly data on company insolvencies (all types) from 2010 to Q2 2020.

Year 2010, of course, was in the midst of the last financial crisis, and you can clearly see the increase in company failures through to 2012 as companies came to grief through reduced economic activity and the credit squeeze that was the core feature.

Thereafter, the volumes of company failures reduced month on month through to the start of the pandemic.

The last quarter’s data is Q2 2020 (April to June) and you can see the big drop in numbers that happened as soon as the pandemic hit. There are two big peaks in quarterly stats, which were caused by HMRC action to compulsorily close down several large providers of service company “umbrella” operations, with a few thousand one-off closures of connected companies at once. These are of passing interest, but do not alter the core history.

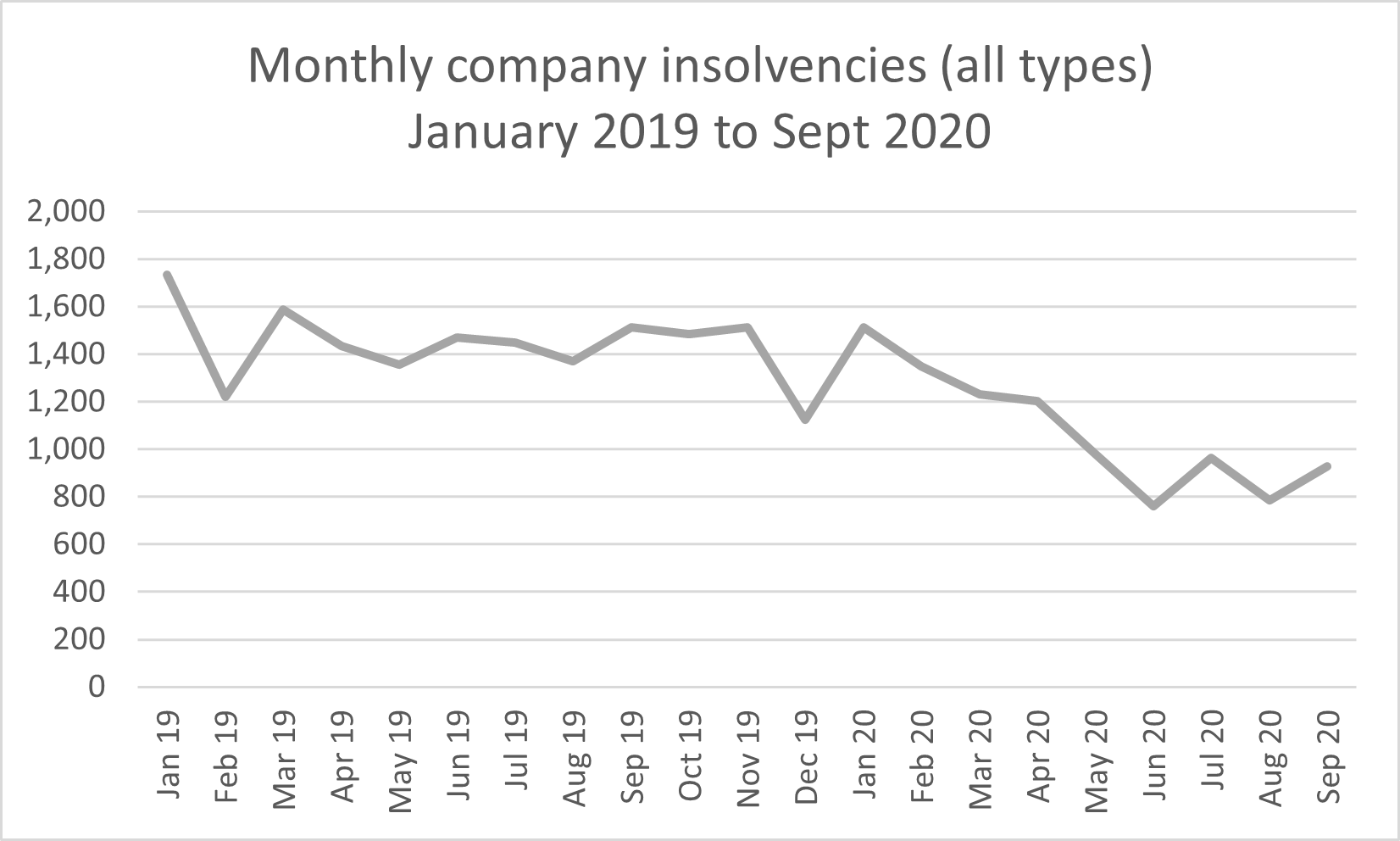

At the start of the pandemic the Insolvency Service started to publish monthly data, rather than quarterly data, so that a quicker, albeit cruder, picture of the effect of the pandemic could be seen very quickly. This data was provided for the months from January 2019 and is shown below.

The key feature of this graph is that, since the pandemic started, company failures have started tracking at about 40% of the pre-pandemic level.

This can only be due to the combined effect of the government rescue measures, and some degree of hope and, perhaps, failure to face up to reality by some business owners. It is only to be expected that a business owner will clutch at any lifeline that is offered.

However, I remind you of the message of the first graph – there is always a level of business failure.

The number of companies failing was dropping after the shake-out of the financial crisis, as business owners became more cautious, perhaps, and banks were much more prudent in their lending (pre-2010 there was a level of bank lending to small businesses that is best described as “brave”, in some cases).

If the rescue measures now in place are delaying the inevitable for some businesses, we may expect to see a large spike in company failures in the next couple of years. Though that is not certain.

We have some crunch dates coming up:

- CBILS loans came with a repayment and interest holiday in most cases at the outset,

- VAT could be deferred until March 2021,

- self-employed income tax payments could be deferred from July 2020 to January 2021.

The Chancellor has provided generous time to pay measures for deferred VAT and tax:

These schemes will help with cash flow, although eventually sums owing will need to be paid.

I cannot claim a crystal ball, but evidence seems to suggest that the ending of government support - whenever that may be - will see a number of business failures of companies that may otherwise already have failed, with those companies that emerge in a fragile state from the pandemic perhaps needing further help to avoid adding to the numbers.

All we, as business advisers, can do at this stage is keep very close to our clients, making sure that they are predicting their future cashflows and trading at a realistic level, and ensuring that they are alert to the risks that lie ahead over the next couple of years.

If you would like to discuss how best to manage your business through the pandemic, please contact a member of the Restructuring team or your usual Bishop Fleming adviser in the first instance.