-

Automotive

-

Charities and Not for Profit

-

Education

-

Energy, Renewables and Natural Resources

-

Food and Drink

-

Healthcare

-

Hospitality and Leisure

-

Housing Associations

-

Manufacturing

-

Private Client

-

Professional Services

-

Public Sector

-

Real Estate and Construction

-

Technology, Media and Telecommunications

-

Transport and Logistics

-

Owner Managed Businesses

Specialised accounting and advisory services tailored to owner-managed business clients.

-

Family Business

Proactive advice and support to help family businesses grow and protect their future.

-

Private Equity Backing

Meeting the diverse needs of businesses involved in private equity transactions.

-

Private Client

Practical advice on all aspects of your individual and personal tax and financial needs.

-

Public Sector and Education

Comprehensive advisory services for public sector, local government and education organisations.

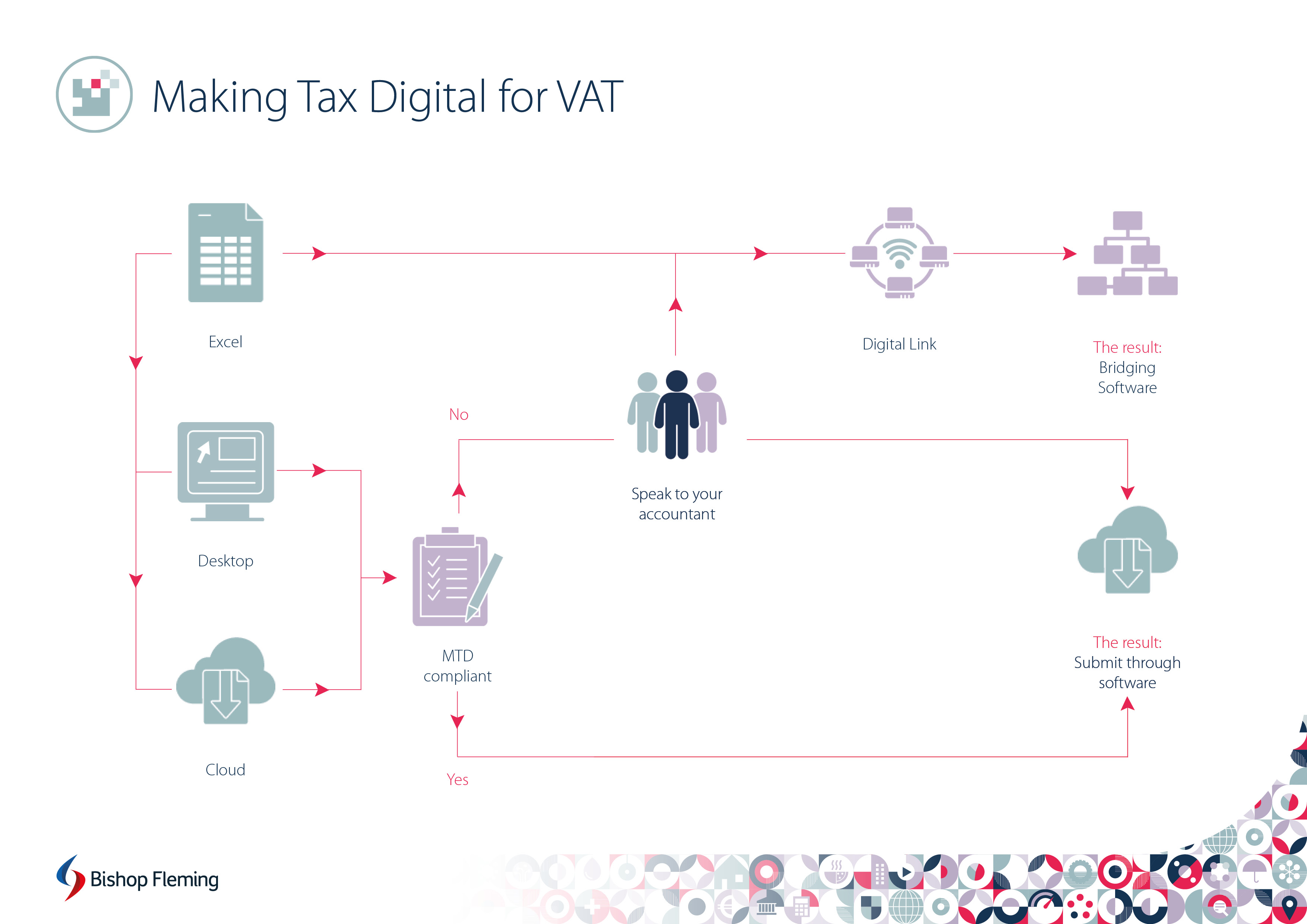

Making Tax Digital for VAT

‘Making Tax Digital’ is a requirement for all VAT registered businesses unless they are exempt. This means you need to keep records digitally, submit returns using software and connect accounting systems with digital links. To help you determine what steps you may need to take to be compliant, we have provided a downloadable flowchart.

If your businesses still keeps manual records, you will need to consider your options and start using spreadsheets or accounting software. Even if you are already using spreadsheets or software, it is worth investing time in reviewing your current accounting system to ensure you are working as efficiently as possible while remaining compliant.

Keep up to date

Ideas are just the beginning

Stay informed about all our latest updates and services, and sign up to our email newsletter.