Our specialist manufacturing team provide a tailor-made service to meet your needs and fulfil your objectives

We know that our manufacturing clients find it useful to hear how our other clients are coping in the current economic climate and the challenges, and opportunities that have presented in the manufacturing sector.

Mark Richdon and Joe Coghlan caught up with James Cole, Group Finance Manager of Ensinger, to discuss the impact of Coronavirus, Brexit, and the skills gap on the business.

About Ensinger Limited

Ensinger is a global engineering plastics company headquartered in Germany, with a large presence in Europe, North America, South America and Asia. The company was set up in 1966 by the original founder Wilfred Ensinger and is still very much a family-owned business today.

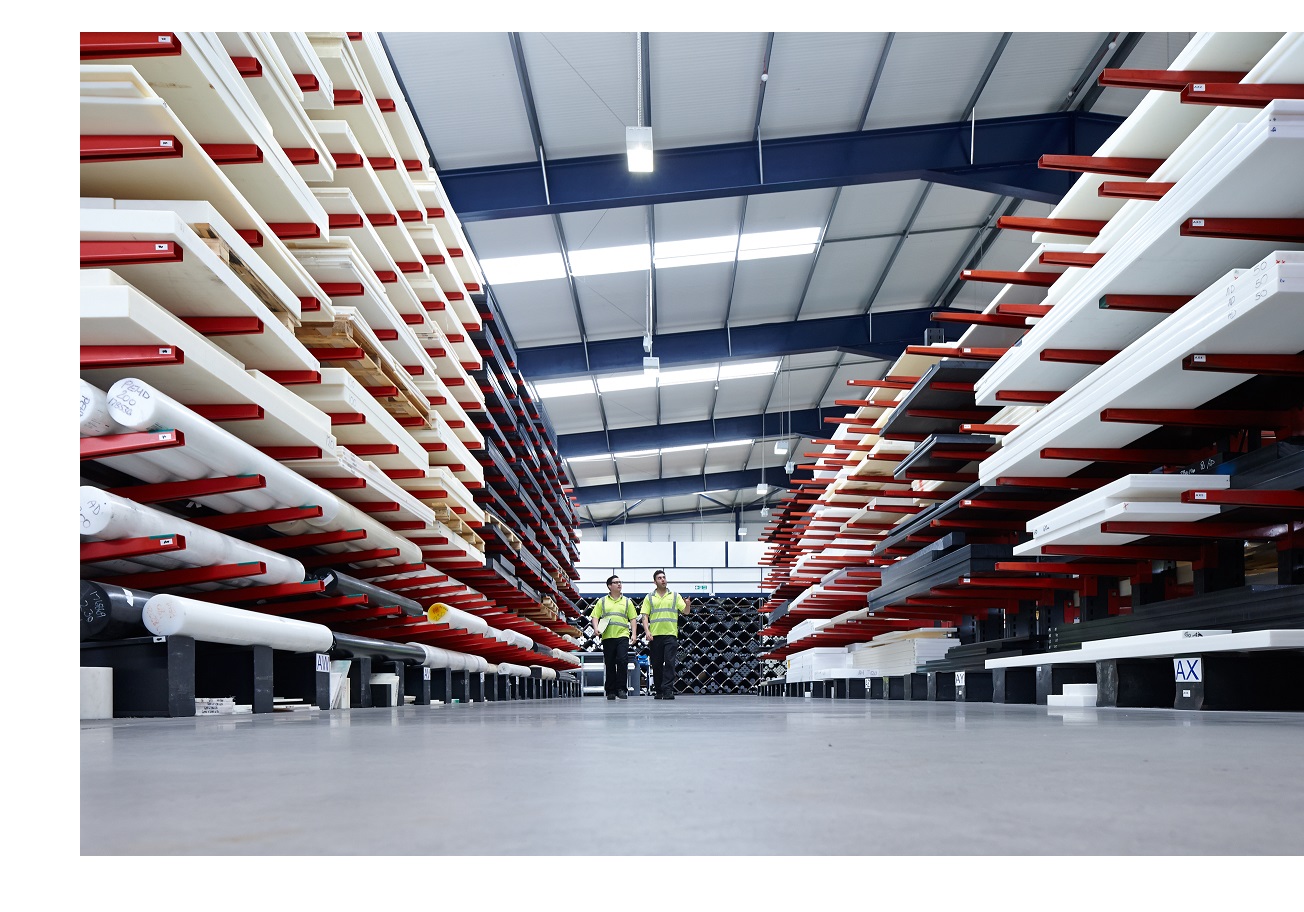

The company manufactures plastic sheets, rods and tubes that are used in the aerospace sector, Formula 1 automotive, medical and oil & gas. Ensinger’s customers include McLaren, Mercedes, Biomet, Airbus and the Ministry of Defence.

Ensinger UK has around 290 employees across 6 trading entities, and there are 7 sites across the UK.

Tell us about your suppliers

"We have relatively little control over the raw material producers. However, as one of the larger plastic manufacturers in the industry we have strong buying power which means we have very good negotiability at the raw materials stage.

The majority of suppliers the UK group trades with are in Europe, so we do import about 60% from our parent company and the other 40% is from third party suppliers. I would say that most of that 40% is from two or three big players, so it is quite a small supply chain."

Have you always formed part of your Supply Chain yourself?

"The simple answer is no, as we have no plans to be an Original Equipment Manufacturer (OEM) type business.

We are not involved at the raw material (oil, pellet/powder) production stage due to 3 or 4 large players globally, meaning there are a lot of barriers to entry at that stage of the value chain. We do manufacture semi-finished products (sheet, tube and rod forms) from raw material plastic components.

The UK branch feel we are already occupying the stages of the value chain that we want to, but having said that we are always looking for new technologies within the plastics industry.

An example of this is the fact that we are going quite heavy in terms of R&D at the Global level into composites (carbon fibre integrated with a plastic called PEAK).

A big opportunity and risk for us is 3D printing. It is a big technology coming into the industry generally and something I’m sure most people have heard of.

It is not a threat to us yet at our level as it simply cannot produce components to the same level that our CNC engineers can and to the same tolerances.

However, the expectation forecast is that in the next 10 years that could start becoming possible genealogically, in which case it will become a major threat to our business, and we will have to adapt and be involved in that industry."

What gives you competitor advantage at the moment - why do customers come to Ensinger?

"Good question!

I would have to refer to the different stages of the value chain, as it is quite different in terms of how the competition operates.

Ensinger UK’s first stage is distribution. We are importing the semi-finished product to the UK and distributing it around the UK to businesses including our own factories.

What sets us apart in that area is that in the UK we have a 45% market share, so we are the biggest at what we do and as a result of that we keep the largest amount of stock- which is a clear USP!

We also try to differentiate ourselves in terms of delivery to market, as we can take orders up to 8pm and can guarantee delivery by lunchtime the next day UK wide.

The next stage of the value chain is the manufacturing; engineering expertise is the simple answer there. We market ourselves as having some of the best engineers and we have the biggest dedicated plastics machine CNC shop between the two factories, and Ensinger is more than double the size of the nearest competitor."

What keeps Ensinger up at night?

"I think for us the challenges we face are industry specific, such as oil & gas and aerospace.

The aerospace companies we are speaking to are forecasting pre-COVID recovery by 2023 or 2024. That presents a challenge for us to replace the turnover in that industry and protect our bottom line.

The biggest challenge we face, if I am honest, is a lack of skills in the market and a challenge to find CNC engineers and shop floor level people with sufficient skill.

It is a very highly skilled job where they have to look at a different engineering drawing daily and programme a CNC machine to make the component tolerances of micro metres.

Part of this challenge is due to our location, as our catchment area isn’t in the large cities such as Bristol, Cardiff and Newport."

What does Ensinger do to address the skills shortage?

What does Ensinger do to address the skills shortage?

"We have had to be quite creative with mitigating measures.

One example of this is in 2016 we set up a sustainability programme in both our factories, and a key component of this was to develop a new apprentice programme in house where we recruited our own apprentice trainer.

The apprentices all study at college for their GNVQ, whilst being trained in-house. The idea is that we will train them for up for 5 years to try and up-skill them as best we can.

This is a direct result of the skills challenge is the market, but also the fact that we have an aging population of our higher skilled guys in the factories.

The other side of the sustainability programme was to improve our technology and efficiency/utilisation where possible.

An example of this is in one of our factories: Ensinger Precision Engineering, based at our headquarters in Wales. It is a robotics cell whereby the programming for these machines is done in an engineering office, so is what we call offline programming rather than a skilled person programming at a machine. That allows us to have a lower skilled person run the machine and helps with our capacity levels, as minimal manning is required."

The last 6 months have been tough for businesses due to COVID. How was the Chinese element of Ensinger affected?

"The Chinese factory had to shut down for most of February during the height of COVID in China back then.

They were able to open again by March. As I understand it the Chinese economy had a mini boom as they came out of COVID, but having recently spoken to my Chinese counterparts they are now seeing similar effects to us, which is circa 20-25% down on turnover.

In terms of the UK branch, we set two main objectives which were primarily the health & safety of our staff, and to do our upmost to keep the cogs turning to prevent jobs being lost.

It was a challenge for us as a lot of our staff aren’t office based and need to work on machinery, so we sent some people to work from home and implemented social distancing rules in the factories with PPE and sanitiser available.

However, we took in over £1.2 million of work in the first quarter of COVID as we were a key component for the medical supply chain for ventilators and the CPAPs that Mercedes were making.

We had a record month in April. It was our first time that we hit over £2 million in one month!

We tried to look at ways we could maximise the opportunity as the level of orders for ventilators started dropping off in May and June.

We created our own product, that is a contactless door opener which can be used on cash machines, so that you can press buttons without any contact on the machine."

How easy was it to diversify what you do and start creating something new?

"There were logistical challenges in terms of procuring material from third party suppliers and getting it to us as quickly as possible for our customers that were working directly for the government.

There were some challenges in our machine shops. However, the main customer we provided to was Mercedes, so we had a lot of input from them to help with tooling and getting everything geared up quickly."

Have your competitors been a threat to you during COVID?

"Not yet, other than the threat of pricing and the price competition in the marketplace.

Since 2016 and Brexit our competitors have clearly taken the foreign exchange hit at headquarters just to maintain their price levels.

We did start experiencing cases where our competitors were going to market at a lower sales price than our purchase price, which was a major challenge.

However, we feel that we are global market leaders in our industry, so do not need to react to that and should be setting prices, not lowering ourselves to competition.

We are expecting more marketing and price challenges with COVID and Brexit over the next few months."

Brexit is obviously a big challenge- is there anything you have put in place with Ensinger entities in Europe ahead of a No Deal Brexit?

"Yes. It has been a big topic for us since mid-2017 when we set up a Brexit steering group internally to look into how this is going to affect us, and to obtain information from various sources including yourselves at Bishop Fleming.

We will need to calculate any implications of tariffs, and our estimation is that we will need to go under World Trade Organisation rules and would attract around 6.5% tariffs - which equates to around £1 million for us, so serious money!

We have tried to look at Brexit as an incentive to grow by contacting all of our customers stating that Brexit deadlines are approaching, and border problems are likely so they should pre-order from us and stock up.

I am leading our Brexit group, so I am actively contacting our couriers and suppliers to make sure they are compliant.

We have mainly been taking advice from experts like yourselves to make sure we are doing as much as we can early on, and budgeting as best we can."

How do you see Ensinger fairing in the next 6-12 months and what would you like to see come out of the next Budget for the manufacturing sector?

"The main one for us is maintaining R&D tax credits and government grants for development projects, such as for our robotic cell project.

High tech manufacturing businesses would also benefit from an extension of the furlough scheme, because it is clear to us that the orders aren’t there at the moment, so everyone is suffering the same problem."

There is definitely a big challenge ahead!"